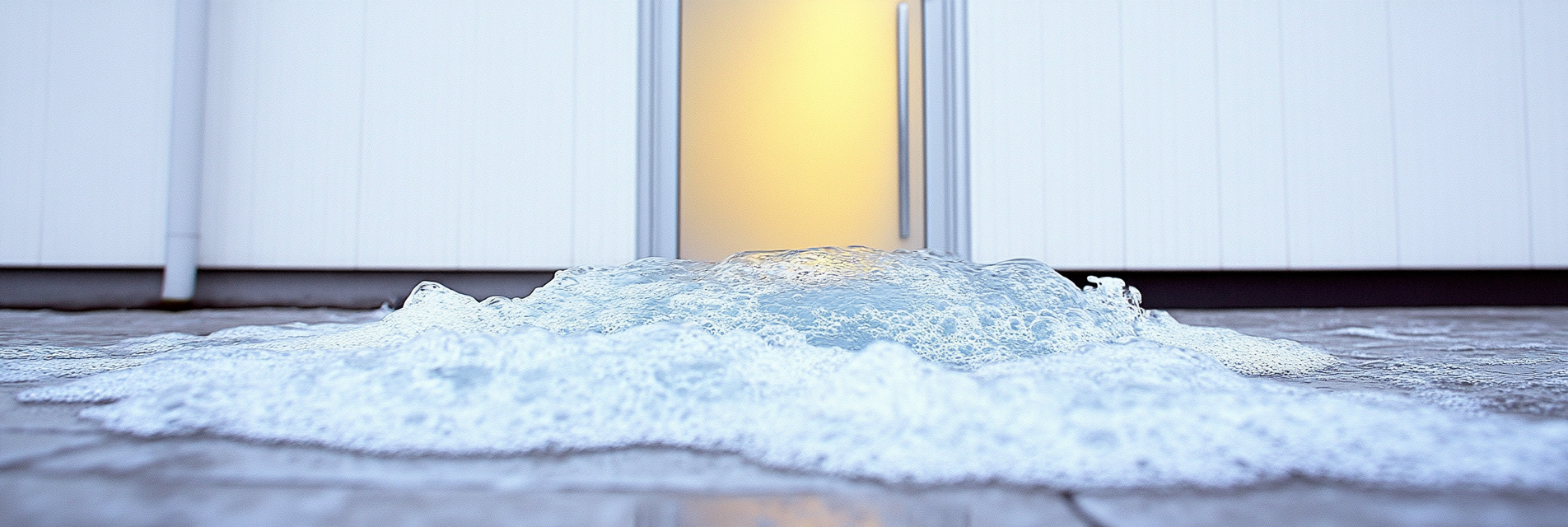

Heavy rains. Leaking roof. Backed-up drainage. These disasters can occur unexepectedly and costs a lot of money. It’s important to know what your home owner’s insurance for your home here in the Tri-Cities covers, and what it doesn’t. This article walks through what rain and water damage coverage by your insurer may actually look like, and it includes some tips for protecting your home – whether you live in Kennewick, Richland, or Pasco, or an of our beautiful outlying area.

1. What Does Rain and Water Damage Coverage Include?

Standard home insurance policies cover certain types of water damage, but not all. Here’s what policies most likely cover (check your individual policy to be sure).

Typical Coverage:

- Sudden and Accidental Damage: Covers water damage caused by unexpected events such as a burst pipe or a leaking roof because of heavy rain.

- Storm-Related Damage: Damage to your house caused by rain entering due to wind damage (e.g., broken windows or torn-off shingles).

- Personal Property: Protection for personal items such as furniture and electronics damaged by water if covered under the descriptions above.

Important Note: For the damage to be covered, the water damage must result from a sudden and unexpected event. Slow leaks or damage due to negligence probably will be denied.

2. What Is NOT Covered by Standard Policies?

Standard home insurance policies have limitations on what types of water damage are covered. Here are the common reasons your claim would be denied:

Common Exclusions:

- Flood Damage: Damage caused by rising water or flash flooding is not covered under standard home insurance. A separate flood insurance policy is necessary for this type of coverage. This surprises a lot of people.

- Sewer Backups: Water damage from backed-up drains, sewers, or sump pump failures is generally excluded unless you have a specific water backup endorsement.

- Long-Term Leaks: Gradual damage from a slow leak or moisture buildup over time is not covered. This type of damage is considered a maintenance issue.

Pro Tip: Conduct regular home inspections (or call Ryan Brightman at Proper Home Inspections (https://properhomeinspections.com/) like we do), and do regular maintenance to your house to avoid issues related to neglect.

3. How to Supplement Your Water Damage Coverage

To ensure your home is comprehensively protected, consider adding endorsements or purchasing additional policies. We endorse Adam Hoover with Country Financial for all home owner’s insurance needs (https://advisors.countryfinancial.com/usa/wa/kennewick/adam-hoover).

Supplemental Coverage Options:

- Water Backup Endorsement: Covers damage from water backing up from drains, sewers, or sump pumps. These are not usually covered by your standard policy because they fall under maintence you should be doing.

- Flood Insurance: Essential for homes in flood-prone areas, covering damage from rising water and flash floods. It’s not as important here in Kennewick, Richland, and Pasco as in other areas of the state of Washington, but it still is an important consideration when reviewing your personal situation.

- Extended Dwelling Coverage: Adds an extra layer of financial protection for you by increasing the policy limits for structural damage.

Product Recommendation: Install smart water leak detectors that alert you to leaks early, preventing damage from growing beyond what it may initially only have been.

4. How to Prepare Your Home for Heavy Rain

These steps can reduce the risk of rain and water damage and help simplify the claims process if you do suffer from damage.

Preparation Steps:

- Inspect Your Roof: Regularly check your roof for damaged or missing shingles and make the necessary repairs.

- Clean Gutters and Downspouts: Ensure they are clear of debris to allow rainwater to flow away from your home.

- Seal Windows and Doors: Use weather stripping and caulking to prevent water from seeping in during heavy rain.

- Install a Sump Pump: A sump pump can help prevent water damage in basements by pumping out excess water.

Pro Tip: Place valuable items in waterproof storage containers and keep them elevated in case you experience any flooding.

5. Filing a Rain or Water Damage Insurance Claim

If you experience water damage, following the proper claims process is important for prompt and what you would consider a fair reimbursement.

Steps to File a Water Damage Claim:

- Document the Damage: Take detailed photos and videos of all damaged areas and items.

- Contact Your Insurance Provider: Notify your insurer immediately to start the claims process.

- Prevent Further Damage: Take steps to mitigate further damage, such as placing tarps over leaks or drying out wet areas. Keep receipts for any emergency repairs.

- Consult with an Adjuster: Be prepared for an adjuster to visit your property to assess the damage and provide an estimate. Read all about this important part of the claims process here: https://dryerfirefighters.com/the-role-of-an-insurance-adjuster-in-home-insurance-claims/

Expert Tip: Keep a record of all communication with your insurance provider.

Conclusion

Rain and water damage considerations are an important part of your home insurance coverage plan. By understanding your specific policy’s inclusions and exclusions, taking preventive steps, and knowing how to file a claim, you can protect your home and finances. We here at Dryer Fire Fighters encourage all Tri-Cities homeowners to regularly review their policies and stay proactive in maintaining their homes to minimize the risk of water damage. You can read more here: https://dryerfirefighters.com/reviewing-your-home-insurance-policy-annually-why-its-important-and-how-to-do-it/

Serving the communities of:

Kennewick | Pasco | Richland | West Richland | Finley | Burbank | Benton City | Prosser | Grandview | Connell

As the sole certified dryer exhaust technician recognized by CSIA.org in the Tri-Cities area, Paul brings a wealth of expertise to fire prevention. His primary focus lies in addressing the root cause of many residential fires: lint buildup in dryer cavities and vents. Through rigorous inspections and thorough cleanings, Paul ensures that families and businesses can enjoy peace of mind, knowing their properties are safeguarded against fire risks.